The Burden of Navigating Changing CMS Rules and Regulations

The calendar year may be months shy of 2024, but a renewal period is coming long before it’s time to make your New Year’s resolutions. Rules and regulations related to Medicare reimbursement will reset on October 1st—the beginning of the new federal fiscal year, with other rules and regulations to follow.

Consider this: According to the American Hospital Association’s Regulatory Overload Report, hospitals, health systems and post-acute care providers have spent nearly $39 billion per year solely on administrative activities related to regulatory compliance. So why is it so costly and hard to keep up?

Each year, the Centers for Medicare & Medicaid Services (CMS) comes out with new rulings for hospitals and health systems to use for reimbursement, including new coding and billing procedures, driving these regulatory compliance challenges. The FY 2024 IPPS Final Rule was recently released and will go into effect on October 1. In addition to the big rule changes, CMS sends out other changes throughout the year. Read on to discover some of these new regulations, when they’re coming, what you need to know and why it matters.

Changing Regulations Require Process Changes, Re-Training and Complex Reporting

In addition to providing quality care to their patients, providers have a large regulatory burden that is driven by these complexities, formulas and rules. As if understanding these mandates wasn’t already a challenge, the consistently evolving regulations add a confounding factor for health systems. It’s near impossible to stay ahead of the changes and avoid leaving money on the table.

New rules mean health systems must recalibrate, retrain coders, update automatic coding, and if using a vendor, make sure that the vendor is updating all of their material to the latest rules and regs. This regulatory burden can prove incredibly difficult for systems to manage while they simultaneously strive to devote resources to providing the highest quality of care.

For many organizations, financial reporting can become a headache, thanks especially to changing billing and costs and varying fiscal years. For example, if your hospital’s fiscal year begins January 1 but the federal fiscal year begins October 1, you’ll need to submit Medicare reimbursement reporting knowing how many dollars were billed before and after October 1. This results in an enormous bookkeeping effort where it’s easy to miss nuances related to cost reporting (in addition to other rules and regulations).

Updated Requirements and Resources to Help Support Compliance Programs

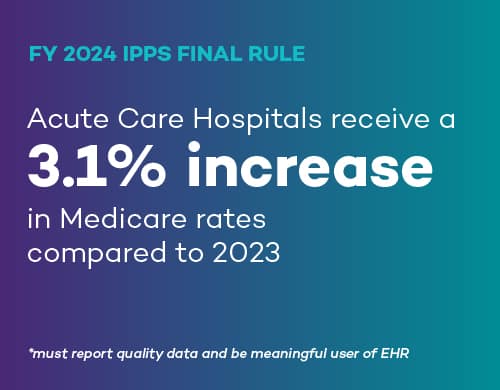

FY 2024 Inpatient Prospective Payment System (IPPS) Final Rule

A big change with the FY 2024 IPPS final rule is that acute care hospitals that report quality data and are meaningful users of EHRs will receive a 3.1 percent increase in Medicare rates in FY 2024, compared to 2023. Additionally, the rule established 15 new Medicare Severity Diagnosis Related Groups (MS-DRGs) for FY 2024, and 16 have expired. This means new codes and new rule mapping, among many other tasks.

FY 2024 Hospital Outpatient Prospective Payment System (OPPS) Proposed Rule

Although the CMS final ruling for OPPS is not yet released, health systems are likely familiar with the overall direction given the deadline to provide commentary on the proposed rule ended on September 11, with a final ruling due to come in 90 days. Stay up to date on current OPPS rules and regulations by visiting our OPPS Resource Center.

Medicare Physician Fee Schedule

The Medicare Physician Fee Schedule determines what hospitals get for reimbursement each year. The current fee schedule is still in the proposed rule state, with commentary ending this past September 11. A final ruling for FY 2024 should be issued within 90 days.

Medicare Part D Cost Reports

Per the CMS, the average total monthly Part D premium is projected to decrease from $56.49 in 2023 to $55.50 in 2024.

No Surprises Act Independent Dispute Resolution (IDR) Fees

As of August 25, 2023, all federal IDR process operations were suspended to comply with a court order and opinion. As of September 5, 2023, CMS has restored a $50 fee for new No Surprises Act payment disputes. According to CMS.gov:

“Effective September 5, 2023, the Departments have directed certified IDR entities to proceed with eligibility determinations for single and bundled disputes submitted on or before August 3, 2023. All other aspects of Federal IDR process operations remain suspended. Disputing parties may continue to engage in open negotiation.”

Health Resources and Services Administration Audits

Failing to comply with HRSA 340BH audits means health systems risk being removed from the 340B Program or being held liable to manufacturers for refunds or discounts. Check out the HRSA Resource Center to help your health system stay ready and up to-date on compliance with the 340B Drug Pricing Program. Plus, keep up with all 340B Developments regarding legislation, administration and manufacturers.

Coming soon! Keep an eye on our IPPS Resource Center for everything you need to know related to the FY 2024 IPPS Memo and Final Rule, including a list of the top changes impacting providers.

Plus, join our webinar on October 5th at 12pm EST to learn more about the 2024 IPPS Final Rule, plus CMS updates you should know.

Take the Next Steps to Ensure Compliance and Cut Administrative Costs

The ongoing regulatory complexity and high cost of compliance doesn’t mean that revenue recovery is impossible. With the right strategic partner, you can focus more of your efforts on what matters most—providing high-quality clinical care. We can help with the regulatory complexities to ensure you avoid leaving money behind. In some cases, hospitals are leaving millions of dollars behind due to the complex rules and regulations landscape.

Take the first steps to becoming a Medicare reimbursement star by downloading this tip sheet to help align your current resources and identify any gaps to ensuring regulatory compliance.