Hospital transfer DRG revenue challenges continue each year as patients are sent to other facilities and home healthcare. Did they use the correct codes to avoid underpayments? Will a government audit uncover alleged over payments? We wondered how the government sees this process and are taking a closer look in this article.

What are transfer DRG (Diagnosis Related Groups)? Becker’s Hospital Review published an article that explains that.

“Under the Post-Acute Care Transfer rule, certain DRGs are subject to reduced payment if a patient is discharged early and receives qualifying post-acute care. Today, over 270 DRGs are subject to reduced payment if the patient is discharged early and receives qualifying post-acute care. 52% of the time, hospitals may not be receiving the full reimbursement when beneficiaries are transferring to facilities or home health.”

The problem is that it’s hard for hospitals to determine if their internal team or vendor has recovered all available transfer DRG underpayments. Many solutions fail to account for cases where post-acute care was delivered in a manner that doesn´t qualify for transfer DRG payments. Since Medicare pays for these accounts, and they are often closed with a zero balance, it is challenging for providers to ensure that they have been paid for all their earned revenue.

And government guidance and policies continue to be changed and updated. Last summer, RevCycleIntelligence reported that, “Other FAQs added in the May 27 update included clarification on special waivers and exemptions that only apply to hospitals paid under TEFRA and billing practices for patients transferred to a temporary acute care location operated by public entities during the emergency period. In addition to COVID-19 billing updates for the IPPS, CMS also released guidance on how hospitals can bill for services rendered at alternate care sites created to increase capacity during the public health emergency.”

RELATED: Key OIG findings about hospital post-acute-care transfer policy overpayments:

The OIG´s August 2020 report found that Medicare overpaid acute-care hospitals more than $267 million as it relates to the PACT policy. The audit findings indicated that where a patient was being seen by home care prior to entering the hospital and then resumed home care upon discharge, the hospital failed to properly code the discharge status to 6 (discharge to home care) or 6 with a condition code 42 (discharge to home care not related to the hospital stay). From an article by R1´s Jim Collins with solution recommendations.

Then there are government audits relating to hospital transfer DRG revenue. DHS Office of Inspector General (OIG) issued a report this past August claiming that inadequate edits and oversight caused Medicare to overpay more than $267 million for hospital inpatient claims with post-acute-care transfers to home health services. What exactly is the government looking for in these audits which can result in fines, staff time costs and revenue reduction? That´s defined in their Post-Acute-Care Transfer Policy which reads like this:

An acute-care hospital transfers a beneficiary to a post-acute-care setting when it stabilizes the beneficiary´s acute condition and the beneficiary requires further treatment. Section 4407 of the Balanced Budget Act of 1997, P.L. No. 105-33, added subparagraph 1886(d)(5)(J) to the Act to establish the Medicare post-acute-care transfer policy, and CMS promulgated implementing regulations at 42 CFR sections 412.4(c), (d), and (f). The intent of this transfer policy is to avoid providing an incentive for a hospital to transfer a beneficiary to a post-acute-care setting early (before the beneficiary´s acute condition is stabilized) to minimize its costs while still receiving the full MS-DRG payment. Using a graduated per diem rate, Medicare adjusts the payment to the hospital to approximate the reduced cost for a beneficiary who has been transferred to a post-acute-care setting.

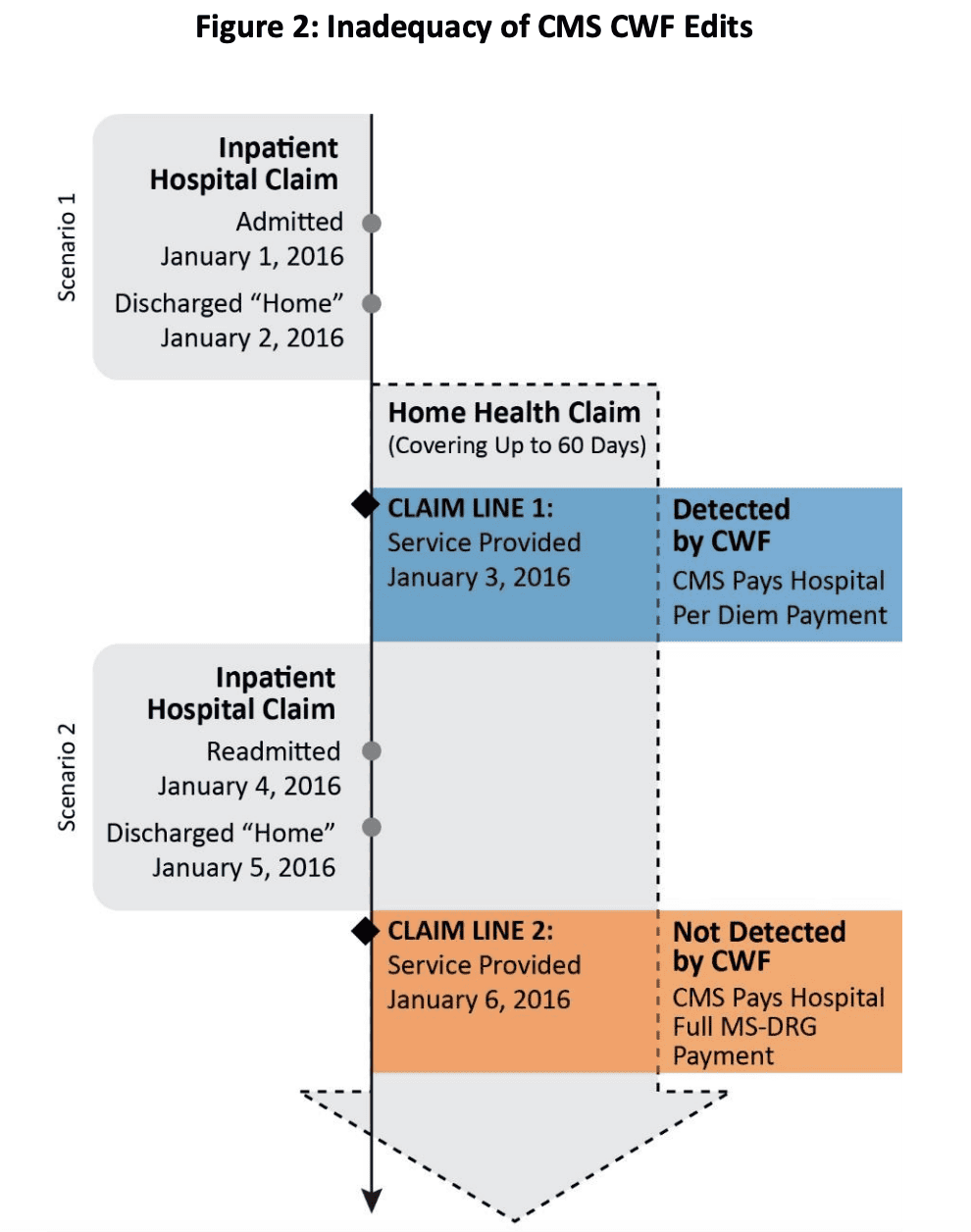

We added the emphasis on the intent of the transfer policy, since that is where many hospitals get stuck with Medicare payment adjustments. A specific example and chart is given in the report detailing how during, 5 of the 58 inpatient claims that Medicare improperly paid, the hospitals originally billed the claims correctly. However, the hospitals later rebilled the claims with a revised patient discharge status code to receive the full MS-DRG payment. The OIG provided this chart:

indicates the Common Working File for each Medicare beneficiary.

At the conclusion of reports like this the OIG makes recommendations to CMS for new policies designed to lessen Medicare payments to hospitals. It is up to CMS to decide how to implement the recommendations.

In a CMS publication, Acute Care Hospital Inpatient Prospective Payment System MLN Booklet, CMS explains how Medicare reduces payment in some cases when a patient has a short length of stay (LOS) and is transferred to another acute care hospital, or in certain circumstances, to a post-acute care setting. This transfer policy applies to patients assigned to one of the MS-DRGs subject to this policy who transfer to a Skilled Nursing Facility, Long Term Care Hospital, Inpatient Rehabilitation Facility, Inpatient Psychiatric Facility, Cancer Hospital, Children´s Hospital or to get home health care from a Home Health Agency or hospice care by a hospice program. In the Transfer Policy section of the Booklet, CMS states that Medicare reduces DRG payments when:

- The patient´s LOS is at least 1 day less than the geometric mean DRG LOS

- The hospital transfers the patient to another IPPS-covered acute care hospital, or for certain MS-DRG patients, a post-acute setting

- The hospital transfers the patient to a hospital not participating in the Medicare Program

- The hospital transfers the patient to a CAH

[LOS = Length of Stay. DRG = Diagnosis Related Group. IPPS = Inpatient Prospective Payment System. A Medicare Severity-Diagnosis Related Group (MS-DRG) is a system of classifying a Medicare patient’s hospital stay into various groups in order to facilitate payment of services. And, The CAH (Critical Access Hospital) designation is designed to reduce the financial vulnerability of rural hospitals and improve access to healthcare by keeping essential services in rural communities.]

The acronyms alone require constant awareness and education on the part of hospital financial teams. We see a lot of our clients struggling to keep up with these governmental policies, DRG related coding, audits and internal policies related to hospital transfer DRG revenue. R1 offers the most comprehensive review and process for optimal revenue recovery for fee-for-service (FFS), Medicare Advantage (MA) and indirect medical education (IME)/shadow billing. Learn more about our solutions and stay tuned for additional updates on this important revenue integrity topic and others, including a look at related strategies for COVID-19 and transfer DRG in a forthcoming article.